PODCAST

Trump Tax Law | How The New Law Affects Real Estate Investors

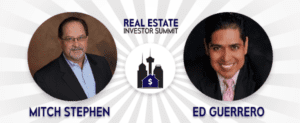

Mitch Stephen chats with

Ed Guerrero

Episode 177:

Ed Guerrero was born and raised in San Antonio. He graduated from the University of Texas at San Antonio in 1987 with a Bachelor’s Degree in Business Administration, majoring in both Accounting and Finance. Ed’s experience includes over 26 years in areas like accounting, auditing, and technology. He became a Certified Public Accountant in 1989. He is also an entrepreneur that owns 12 other affiliated companies. Ed’s interests include Taxation, Finance, Real Estate Investment, and Technology.

During the Last 10 years, Ed has built a CPA practice which now includes over 3,700 clients. Based on each client’s unique situation, he offers the following services: accounting, taxation, IRS representation and technology. His practice employs 20 full-time and 5 part-time personnel. His practice is one of the fastest CPA firms growing in San Antonio at a 65% growth rate in revenue each year. About 80 times a year, Ed speaks about tax strategies and keeping the books to organizations such as UTSA, SBDC, ACCION, Various Chamber of Commerce and Real Estate Associations. Also, by hosting monthly luncheons and dinners for small business owners, Ed had been very successful in providing proactive tax strategies. He coaches and teaches new methods of Accounting, Taxation, Wealth Building, and Tax Strategies.

What you’ll learn about in this episode:

- Ed’s weekly radio show where he answers tax questions

- Being proactive instead of reactive with your tax planning

- Why taxes are not what you have to pay but what you want to pay

- Trump Tax Law: The changes to the deduction process that will impact the taxes you pay, especially if you’re a family with a lot of kids

- Why home equity loan interest can no longer be deducted under the new Trump Tax Law

- Why the Trump Tax Law changes are much better on the business side than the personal side

- The huge tax reduction that makes C corps a great opportunity and a tax strategy to capitalize on this strategy

- The reduction on passthrough income

- Turning personal expenses into business expenses

- Why your kids can work in your business at any age

- Why you’re throwing money away if you don’t own a business

- Passive vs active real estate investing and the tax benefits active investing gives you

- How to get Ed’s free tax analysis

Resources:

- Call Melinda Alexis at 210-490-7100

- 1000houses.com/live

- 1000houses.com/reviews

- 1000houses.com/100

- 1000houses.com/101

- 1000houses.com/Freecall

- 1000houses.com/nomoney

- 1000houses.com/Coaching