Posts by Mitch Stephen

What are you afraid of when raising Private Money?

I hear it all the time: How do you raise private money? It’s the #1 question I get. So after a lot of years I felt it was time to share what works and does not work…in plain English that makes sense. You know there are so many reasons people don’t raise private money. I want…

Read MoreHow to Pay your Taxes or NOT

Are you one of the millions that have a tax bill this year? How did you pay for it…or did you get an extension? You may still save money on your taxes if you have filed an extension…by opening a Tax Free Future account. For example, if you already filed for a business that operates both…

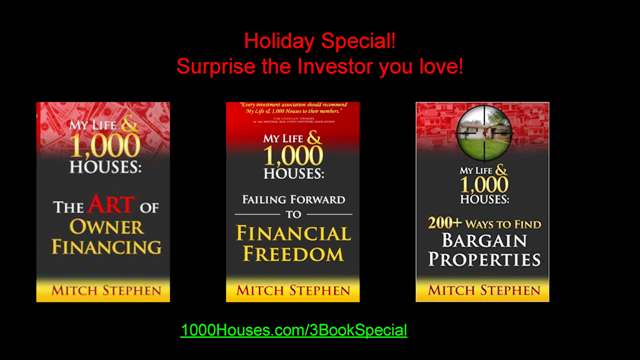

Read MoreBooks Bonanza

This book, like all of Mitch’s books, is a practical step by step guide to financial success. I will continue to use it to sharpen my Real Estate investing skills, especially raising private money, which Mitch clearly shows you how to accomplish.

Read MoreSell That Stinking House

Mitch Stephen’s Special Report: Sell That Stinking House This is a must read report if you want: To sell a house that a pet has been living in. To learn how to remove pet odors and stains from almost any surface. To clean up pet accidents including urine, feces, vomit, blood, and fur. Little known…

Read MorePRIVATE MONEY It’s about the DEAL

Private money is key. You may pay more but there is a certain peace about private money you almost never get with bank money; you can get private money as “non-recourse money.” That is to say; the loan is a collateral only loan and the lender had NO RECOURSE against YOU PERSONALLY. You don’t…

Read More