BLOG

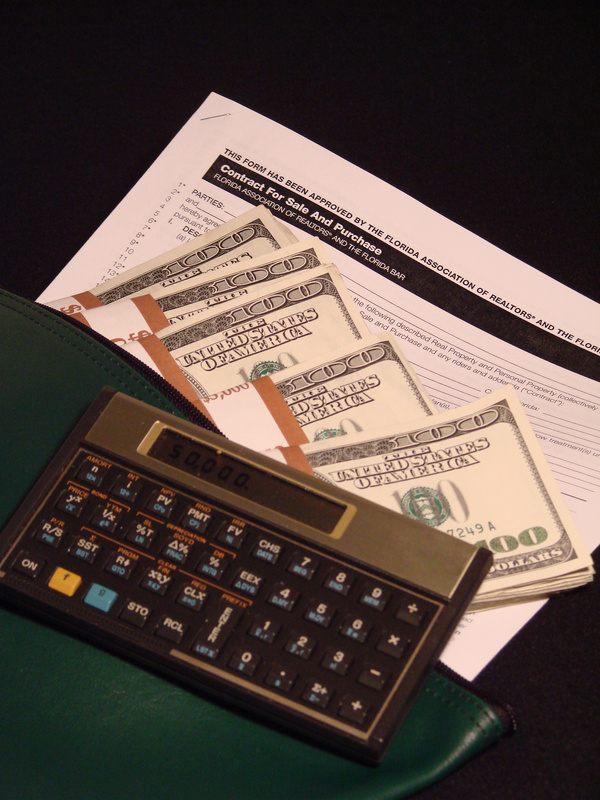

When a Real Estate Deal Falls Through

As always, you are advised to seek your own professional counsel. I am not a licensed attorney. Therefore, by the law as, I understand it, I cannot make any legal representations as to the accuracy or legality of the views or tactics referred to below. The following is my opinion for better or for worse.

We always collect a non-refundable down payment with the application to buy the house before we start the process with our buyer(s). It really is refundable until after the cooling down periods but we write the receipt as “Non-Refundable.” These down payments range from $5k on up.

If they do NOT qualify, and we have to reject the application, it is clearly stated the money spent on credit reports and background checks is non-refundable. We list those fees up front – per buyer, and the buyers agree in writing to accept that risk as their own.

You should be able to work out a preliminary work-up with your RMLO. Our RMLO wants to look at our buyer’s proof of income verses the potential monthly payment. We go forward once we’ve establish that the buyer(s) make enough income to afford the payment; this is free consultation from the RMLO.

Next step is: the RMLO charges us $85 for the credit reports and background checks (1 or 2 of them). After we review these and they are acceptable, we decide to move forward with the full RMLO package.

We’ve never paid full price for someone when and deal falls through and we don’t make it to closing. Thus far, we spent some money for the credit check and background check; $85 for each buyer.

In general, there are 2 buyers at the most; $170.

If we have to deny the buyers, we keep the portion spent on credit and background checks and we refund the balance of the buyer’s down payment.

In my opinion, YOU should never be on the hook for the expenses involved in trying to get your buyers qualified to buy your home.